Soaring Meat Consumption in China Has Global Implications

After writing the piece China's Energy Gaps Create Opportunities last week, a few different articles came across my RSS reader that highlighted the need for a food post as well.

Food is one of those things that I do not think gets enough attention. There are certainly more than enough stories about food safety in China, largely byproducts of lacking investment on the farm and in the distribution chain, but it is China's reliance on imports that will become the story going forward. As the above articles suggest.

According to the Earth First article Meat Consumption in China Now Double That in the United States:

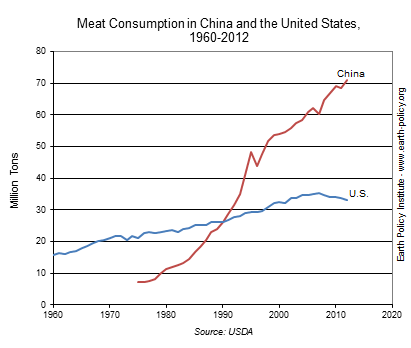

More than a quarter of all the meat produced worldwide is now eaten in China, and the country's 1.35 billion people are hungry for more. In 1978, China's meat consumption of 8 million tons was one third the U.S. consumption of 24 million tons. But by 1992, China had overtaken the United States as the world's leading meat consumer—and it has not looked back since. Now China's annual meat consumption of 71 million tons is more than double that in the United States.

Figures that are represented in the chart above, and highlight very quickly and concisely just how fast China's demand for meats is rising. A rise that is matched by the rising demand for inputs (seed, feed, fertilizer, etc), as the recent articles China's Sinograin may boost imports of U.S. corn and China Soybean Imports to Jump by 14% on Demand

It is a problem that is at the heart of the matter tied to regulation, farm policy, and the distribution of food, and is exacerbated by urbanization and economic development which are fueling demand. And beyond importing, where the opportunities are going to enter for solution providers are going to be (in my opinion) greatest on the farm and in the distribution system.

On the farm, perhaps the greatest shift that is taking place is the one where individual farmers, who are farming on average 660sqm of land, are consolidated through the legal frameworks set up a couple years back. This will be the core for future investment as farm land is bundled up, and is worked to such a scale that a single farmer (of business) is making decisions about the seed to be planted, fertilizers/ pesticides to be used, and means of harvesting/ storing the crop. Right now, it is a bit of every many for himself, where largely uneducated farmers are planning crops and buying seeds with little formal education on agriculture, there is no scale in the fields (i.e very 660 sqm is different), and to pump up yields the farmers through on 2-3 times the amount of fertilizer/ pesticide needed. A huge waste to the system, not to mention the impact to the water.

Which is operationally no different for livestock, aswe painfully learned through the melamine incident, but which I see every time I open up a carton of eggs and see varied sized, shape, and color.

The average farmer has no scale, and as a result is not only wasting inputs and more importantly, sees a huge variance in output as well. It is a market leaves a lot of room for firms looking at financing farm consolidations, farmer training, equipment, inputs, and storage. opportunities that have attracted the likes of Monsanto and Bayer, but have also attracted groups who are selling green houses, irrigation technology, and husbandry technology (live samples and more)

As highlighted by the WSJ article China Grows Its Dairy Farms With a Global Cattle Drive:

To encourage growth of big farms, the government has mandated that the country's top milk processors—those who buy from the farms and turn raw milk into boxed milk, yogurt, ice cream and cheese—purchase a substantial percentage of their milk from big farms.

Foreign companies and financiers have jumped on China's dairy bandwagon. Hong Kong-based private-equity firm Olympus Capital and Mueller Milch, a large German dairy, have invested in Chinese dairies. New Zealand dairy cooperative Fonterra, the world's biggest exporter of milk products, is building its third dairy farm in China stocked with Kiwi cows.

And by the article U.S. barnyards help China super-size food production :

Worldwide, the United States exported an all-time record of $664.1 million worth of live breeding animals, semen and livestock embryos last year, an 82 percent jump in two years, according to the U.S. Department of Agriculture's Foreign Agricultural Service. [...]

Last year, Chinese companies bought $41 million worth of live breeding animals and genetics – up nearly threefold from five years ago, according to USDA FAS.

The demand for breeder pigs, in particular, is zooming after China lifted a two-year ban on hogs and pork imports last spring. In the first two months of 2012 , China imported 62 percent of the total number of U.S. breeder pigs brought in for all of 2011.

With China facing increased pressure on all fronts it is an absolute certainty that China will have to modernize its food production and distribution systems, and as time grows more critical, the need for secure and safe sources of food are going to open up a lot of doors for solution providers.

For those of you who are interested in learning more about the wider context, or learn about the limits of China's agriculture, I highly suggest watching this clip on Youtube where Lester Brown gives a presentation entitled Perspectives on Limits to Growth: World on the Edge . He spends a lot of time on China

(verzonden vanaf tablet)